Malaysia Car After 0 Gst

Meanwhile the import duty can go up to 30 which varies based on the vehicles. Am I required to account for GST on the margin on or after 01 June 2018.

Malaysia May Reintroduce Gst Says Pm Ismail Sabri How Will Car Prices Be Affected Compared To Sst Paultan Org

With immediate effect all Proton cars sold and registered from 16 May to 31 May 2018 will include service vouchers equivalent in value to the difference between the current and new price of the car after GST is zero rated.

. GST is suspended on the importation of goods made by a ATS holder. Perusahaan Otomobil Kedua Sendirian Bhd Perodua is reducing the price of its cars by up to RM3500 as the government rolls out the zero-rated goods and services tax GST beginning tomorrow. All supplies of local and imported goods and services which are now subject to GST at the standard rate of 6 will be subject to GST at zero rate 0 beginning 1 June 2018.

KUALA LUMPUR May 31. So Customs will refund the tax on 20 of RM200000 which is RM40000. Where an invoice is received after 01 June 2018 for services rendered prior to 01.

According to theSun Malaysia has been granted a period of tax holiday - the first time in 40 years - as taxes levied upon products and services will be halted for the time being. Standard-rated 0 will also be applicable for parts and servicing prices at all of Volvo Car. This revised pricing will take into effect starting 1 June 2018 and will remain until further notice or announcement from the Ministry of Finance Malaysia.

The things that you should not forget after 6 GST to 0 on 1 June 2018. Effective 1 June 2018 the GST in Malaysia will be reduced from 6 to 0 which is expected to be a temporary measure with the view of abolishing the GST altogether and the reintroduction of the Sales and Service Tax SST in September. Since GST has been reduced to 0 to pave way for the Sales and Services Tax SST which will only be reintroduced on 1 September prices are expected to drop during this tax holiday that.

Hrv mugen worth to get price sure will be lower after 0 gst by honda. Yes if the purchase was made 3 months before the tourist departs from Malaysia. 10 of that is 4000 compared to the actual sales tax paid which was 10000 said Subromaniam.

The Malaysia Automotive Association MAA is appealing to the government for an extension but its unlikely that it will be granted seeing that the government has already extended the SST cut three times prior. The Goods and Services Tax GST in Malaysia will be set to zero percent 0 effective 1 June 2018. From June 1 Perodua vehicles are on average priced 56 lower than before said Perodua Sales Sdn Bhd managing director Datuk Dr Zahari.

Edaran Tan Chong Motor has released new Nissan prices updated with GST all CKD models and variants are cheaper by between RM190 and RM2724 or between 03 and 20. Yes GST rate on the margin is standard rate of 0. Malaysia is keen on reintroducing a goods and services tax GST as it attempts to expand its revenue base and carry the weight of public subsidies.

Legally we cannot give. Zero rated immediately. The GST standard rate of 0.

Please note that the prices quoted above are on-the-road private registration for Peninsular Malaysia without insurance. Yes the 0 GST bonanza that was scheduled to end today ie. If you deliver it by then you can still get the incentive confirmed MAA.

August 31 has been extended until Nov 15. The GST rate to be applied is 0. Thus giving prospective car buyers one more chance to buy a Volkswagen at cut-down prices that are free from GST burden.

What is the treatment when the GST rate is 0. Additionally PROTON Customer Care is offering a 6 discount on periodical maintenance labour and periodical. Previously only certain goods and services.

However do note that other taxes like excise and import duties still apply. However the prices of CBU models namely the Sylphy Elgrand Murano 370Z and Leaf stay the same as before. Aside from the sales tax vehicles sold are also charged with other taxes namely excise duty and import duty.

According to Volkswagen Passenger Cars Malaysia VPCM vehicle prices will remain the same as under the previous offer. I am a second hand car dealer under the margin scheme Regulation 75 GST Regulations 2014. The story has been updated accordingly.

From 01 June 2018 GST should be charged at standard rate of 0 on the difference between the total value of the supply and the value of the supply before 01 June 2018. Effectively we are reverting to the tax holiday enjoyed in 2018 from June 1 to August 31 which saw the removal of the goods and services tax GST from all car prices. While in Malaysia car dealer sell.

The Sales and Service Tax SST exemptiondiscount for new cars has been extended to 31-December 2021. The move to reimplement GST which replaced the. Image via Bernama via NST.

I am a secondhand car dealer under the margin scheme Regulation 75 GST Regulations 2014. At present the excise duty is set at between 60 to 105 for both locally assembled and imported cars and it is calculated based on the car model and engine capacity. GST should be accountable at standard rate 6 on the value of supply up to 31 May 2018.

This means buyers of locally-assembled CKD cars will be exempted from paying the 10 percent sales tax upon purchase. It will be one month after the end of the incentive.

Malaysia May Reintroduce Gst Says Pm Ismail Sabri How Will Car Prices Be Affected Compared To Sst Paultan Org

Gst Zero Rated Umw Toyota S Car Prices Get Cheaper Paultan Org

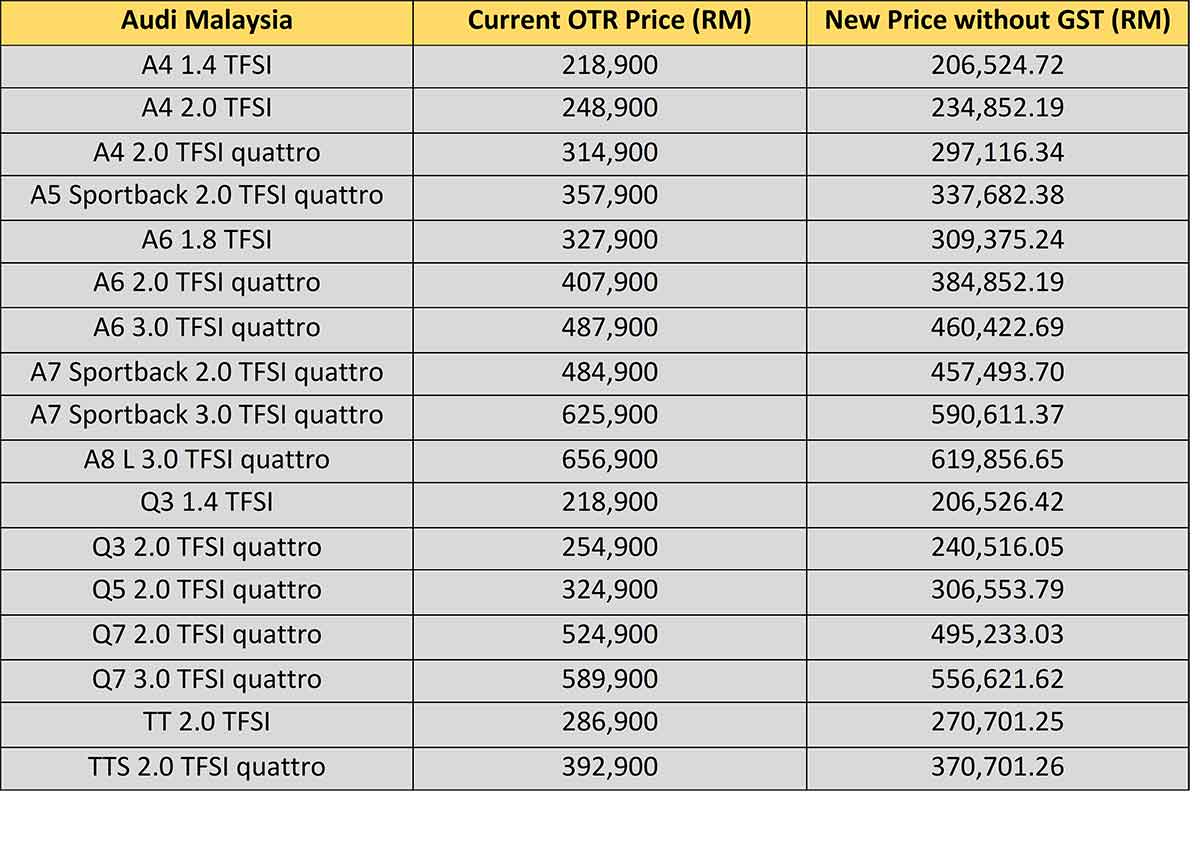

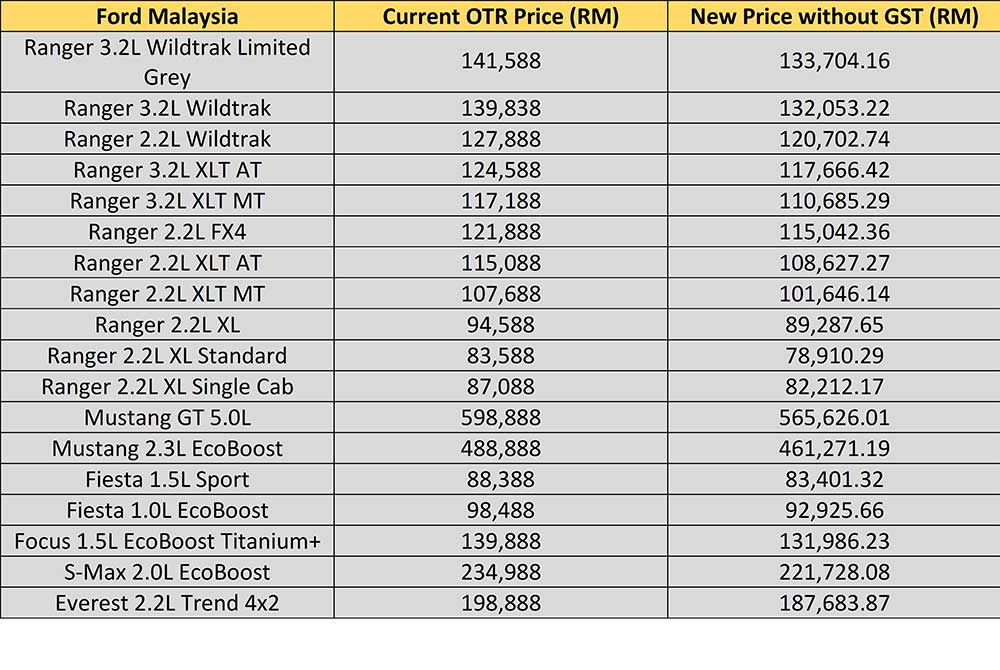

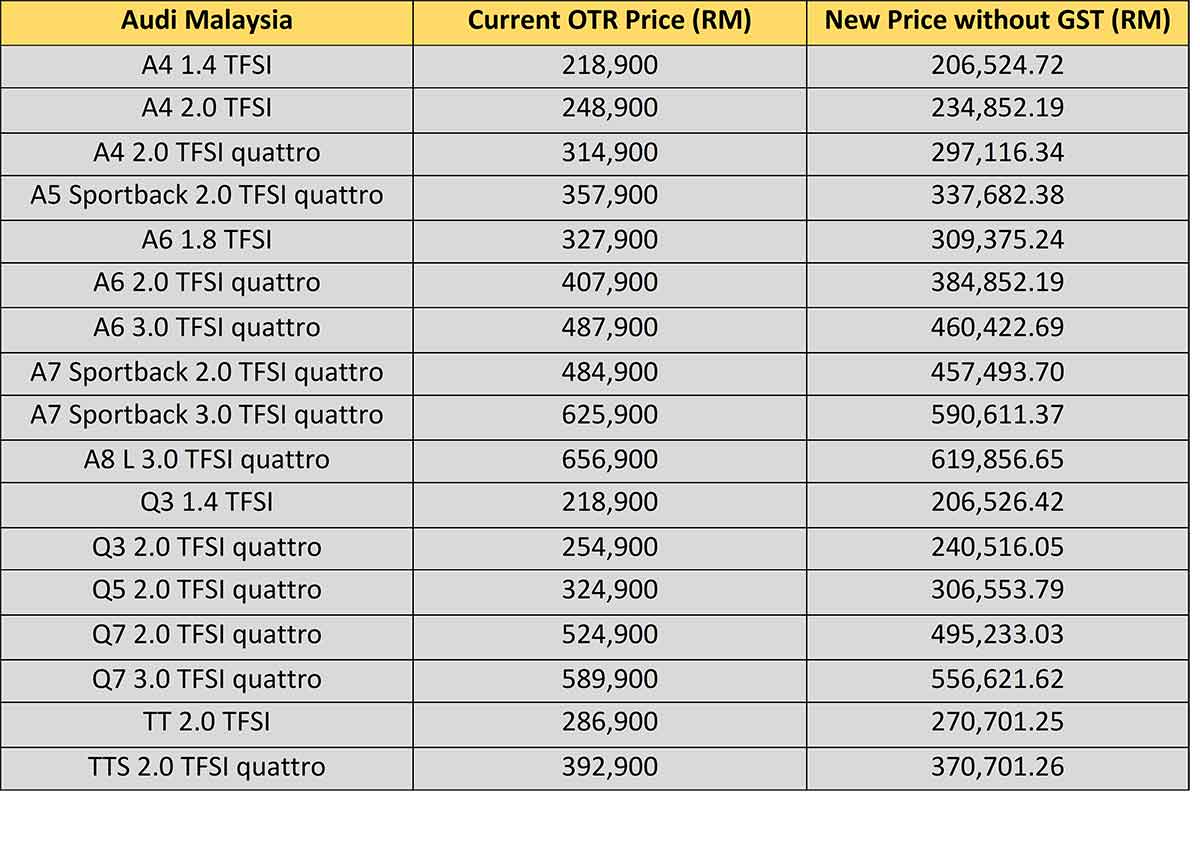

2018 Car Price In Malaysia Without Gst

2018 Car Price In Malaysia Without Gst

Malaysian Car Sales Expected Up With Gst Abolition Wardsauto

2018 Car Price In Malaysia Without Gst

0 Response to "Malaysia Car After 0 Gst"

Post a Comment